HJTA Radio Show & Weekly Podcast

Listen to the Howard Jarvis Radio Show Every Friday Night at 6:00 P.M.

LIVE on:

- 790 KABC in Southern California

- 560 KSFO in Northern California

- KAPC.com and KSFO.com everywhere

California Commentary by HJTA President

LIVE on:

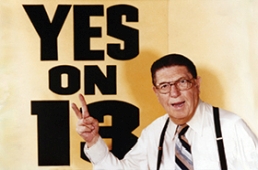

Find out how high your property taxes would be WITHOUT Proposition 13

Today, the Howard Jarvis Taxpayers Association has grown with the support of more than a quarter-million taxpayers! Learn about our mission and how continue to protect taxpayers' rights!

By joining the Howard Jarvis Taxpayers Association, you help us protect Proposition 13 and defend you from property tax increases.

Your continued support of the Howard Jarvis Taxpayers Association helps us maintain our status as watchdog of Proposition 13.

Time for California lawmakers to end home equity theft

April 25, 2024

In May of last year, the United States Supreme Court ruled that home equity theft — the practice of governments taking not just what is owed, but the entire property when they collect a property tax debt — is unconstitutional. Yet almost a full year later, several states have failed to change their laws to comply with that decision. California is one of those states — and by continuing to allow local governments to seize property without compensation, the state will likely face serious monetary liabilities for damages in future lawsuits from wronged property owners. We urge state legislators to...