HJTA Radio Show & Weekly Podcast

Listen to the Howard Jarvis Radio Show Every Friday Night at 6:00 P.M.

LIVE on:

- 790 KABC in Southern California

- 560 KSFO in Northern California

- KAPC.com and KSFO.com everywhere

California Commentary by HJTA President

LIVE on:

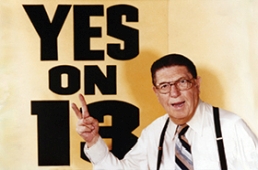

Find out how high your property taxes would be WITHOUT Proposition 13

Today, the Howard Jarvis Taxpayers Association has grown with the support of more than a quarter-million taxpayers! Learn about our mission and how continue to protect taxpayers' rights!

By joining the Howard Jarvis Taxpayers Association, you help us protect Proposition 13 and defend you from property tax increases.

Your continued support of the Howard Jarvis Taxpayers Association helps us maintain our status as watchdog of Proposition 13.

Californians are rapidly losing confidence in the state’s political leadership

April 18, 2024

Mounting evidence reveals that Californians are rapidly losing confidence in the state’s political leadership. That loss in confidence is driven by the perception, much of it based in reality, that our elected officials simply aren’t addressing the real problems facing Californians. Those in power will contend that voters are satisfied with the current political structure because little has changed over the last two decades. But citizens are fully aware that an entrenched political class is virtually impossible to dislodge. Factors that combine to keep the elected officials in power include inherent incumbent advantages, a compliant media, overwhelming financial support from...